2025 has turned short-form video into a knife fight for attention, and creators are caught in the middle. Both YouTube Shorts and Instagram Reels promise reach, discovery, and brand visibility, but which one is better for promoting your content?

In this piece, we’ll strip down YouTube Shorts vs Instagram Reels: what’s working in 2025, where creators are winning (or burning out), and which platform now gives the better return on effort.

The 2025 Scoreboard: YouTube Shorts vs. Instagram Reels

Where should you invest your time? Let’s see what the numbers have to say.

YouTube Shorts

YouTube CEO Neal Mohan used Cannes Lions 2025 to drop one headline stat:

Shorts now averages around 200 billion views per day and reaches 2+ billion logged-in users monthly.

Independent breakdowns back this up and add three important points:

- YouTube Shorts views have grown explosively vs 2024.

- A big share of new, fast-growing channels now rely heavily on Shorts as a discovery lever. Since launching in 2020, YouTube Shorts has seen an 85% annual growth in views, a 65% year-over-year increase in total watch time, and now 72% of YouTube users watch Shorts weekly.

- YouTube Shorts often deliver more views per clip on average than Reels.

We at ScaleLab watch thousands of client YouTube channels daily and also see how big a boost Shorts are bringing.

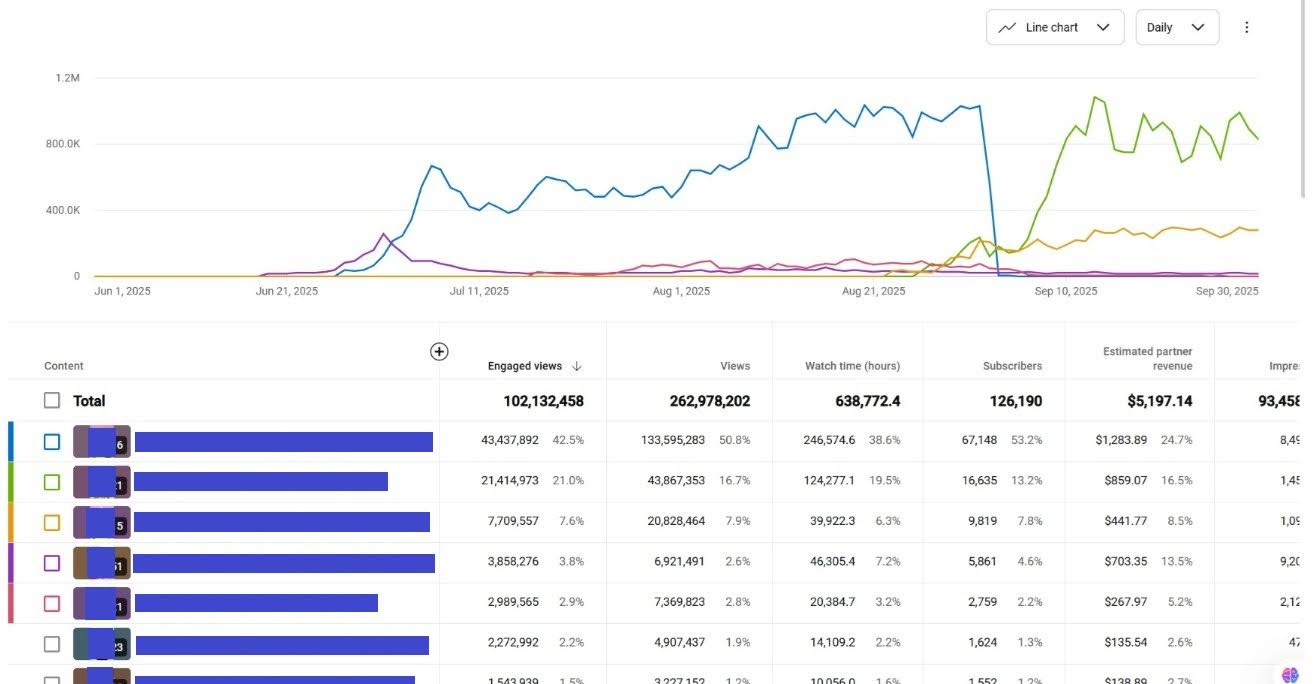

Examples of YouTube Shorts in Action

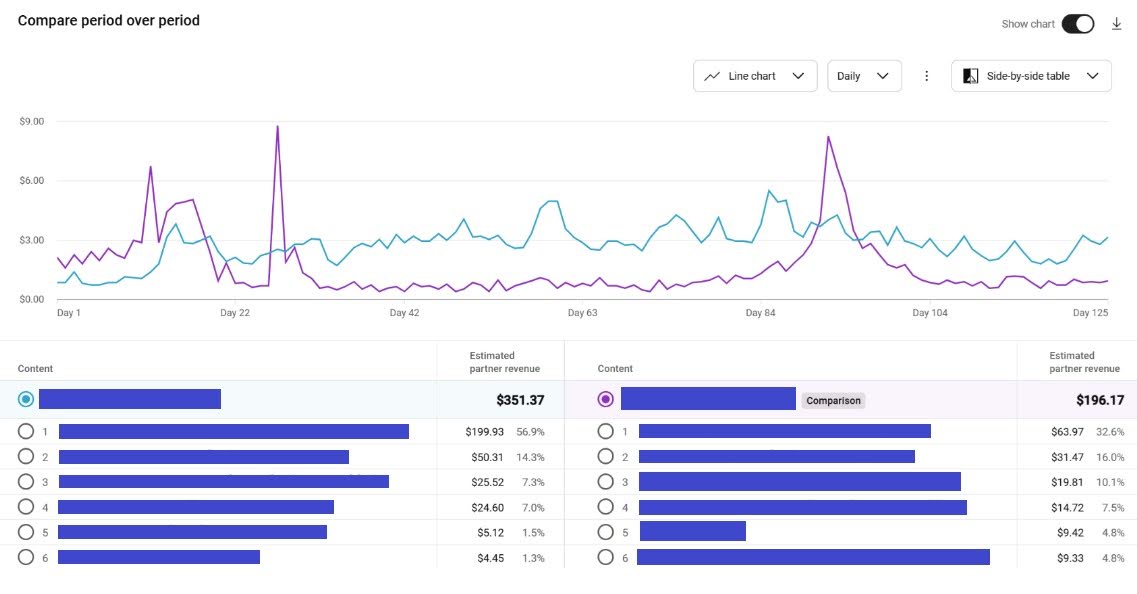

One creator in the arts and crafts niche saw a 64% revenue increase in just 30 days after introducing Shorts. What started as an experiment quickly reignited channel traffic and boosted overall engagement, proving that Shorts can drive both visibility and income without cannibalizing long-form views.

Another creator saw 52% more views and 33% higher revenue within just two weeks of launching a Shorts strategy. The shift brought steady growth in engaged views, proving how frequent Shorts posting directly impacts channel momentum.

A third channel doubled its total revenue in just four months after consistently publishing Shorts. The steady posting schedule kept the audience engaged between long-form uploads, drove repeat traffic, and turned short bursts of virality into sustained growth across the entire channel.

Want results like these with YouTube Shorts?

Reach out to ScaleLab. We’ll analyze your channel and show you the fastest path to growth.

Instagram Reels

Recent 2025 data paints a different but equally serious picture:

- Reels is now central to Instagram: about 2B+ people engage with Reels monthly, and Reels can account for roughly 35% of total Instagram watch time.

- Reels deliver significantly higher reach than photos and many carousel posts, and remain one of the best-performing formats on the platform.

- Influencer and brand campaigns on Reels show strong engagement, with Reels frequently outperforming other post types for discovery and campaign visibility.

Influencer & Brand Context: YouTube Shorts vs. Instagram Reels

Most 2025 reports agree on a few things:

Influencer marketing keeps growing; projected to reach ~$32B in 2025. Instagram is still one of the main channels brands rely on, especially for collaborations, even if budgets are diversifying.

But YouTube isn’t sitting out the brand game either.

In 2025, YouTube rolled out new BrandConnect tools, affiliate tagging, and Shorts-specific sponsorship formats to help creators land more deals directly on the platform.

Official updates from YouTube BrandConnect and Made on YouTube 2025 confirm one clear direction: YouTube wants to make brand collaborations simpler, more transparent, and easier to track.

With YouTube heavily investing in Shorts discoverability, monetization, and ad formats, it’s becoming more than a discovery engine. It’s shaping up to rival Instagram Reels as the next big space for brand partnerships and sponsored content.

Read more on the official blog: Earn More with Brand Partnerships – YouTube Blog.

So, both Shorts and Reels are massive, and both matter. Let’s talk about what creators are actually running into.

Pain Point #1: Viral Views That Don’t Translate

Creators are loud about this in 2025: “I got millions of views – nothing happened.”

On YouTube Shorts

Common pattern:

- Shorts can spike views fast.

- But many creators report lower subscriber and watch-time conversion per 10k views vs long-form on the same channel.

- A large portion of Shorts traffic is swiping behavior: people snack, they don’t commit.

This doesn’t make Shorts useless. It means:

Shorts is top-of-funnel. If there’s no clear path into your main content (playlists, series, pinned long-form, channel identity), those views evaporate.

Creators like Dylan Lemay (ice cream storytelling), Airrack (high-energy challenges), and Unspeakable (Minecraft) stack millions of Shorts views, turning that audience into loyal long-form viewers.

On Instagram Reels

Reels has the opposite complaint:

- Reach can be strong, especially for creators who post consistently and lean into Reels-native trends.

- But growth feels “slower” and more capped compared to Shorts.

- On the flip side, the people who do engage tend to be closer to your actual community, not random passersby.

Creators like Aimee Song (fashion and lifestyle), Zach King (magical VFX), and Chrissy Teigen (food and lifestyle) rack up millions of Reels views, turning their followers into loyal brand collaborators.

So:

- Shorts pain: “Explosion, no depth.”

- Reels pain: “Steady, but not explosive enough.”

If you’re only watching the view counter, both platforms will lie to you.

Pain Point #2: Monetization Reality

Nobody serious in 2025 believes Shorts or Reels will reliably pay rent on views alone.

YouTube Shorts money

Reported Shorts ad revenue shares are improving, but still low on a per-view basis.

We pulled data from ScaleLab partner channels to benchmark Shorts RPMs across key markets. In 2025, the U.S. leads with an average of $0.33 RPM, followed by Switzerland, Australia, and South Korea, all hovering between $0.18-$0.21. Most major markets, including the UK, Canada, and Germany, average around $0.16.

While these numbers remain lower than traditional video CPMs, the scale of Shorts makes up for it. Hitting a million views in a few days can still bring $150-$300 in ad revenue, not impressive per view, but significant in volume and reach.

Real money comes when YouTube Shorts:

- Push traffic into long-form (where RPMs are higher),

- Increase channel demand for brand deals (you can use free tools for that),

- Or act as proof of audience for off-platform monetization.

If you’re expecting Shorts-only income to stabilize a business, you’re exposed.

Instagram Reels money

Reels monetization is messy but strategic:

- Direct tools (Gifts, shopping, branded content tags, and affiliate features) are widely available and familiar to brands.

- 2025 influencer reports still show Instagram as one of the top channels brands choose for campaigns, especially lifestyle, beauty, fashion, and travel.

Creators who treat Reels as a brand-building and deal-closing layer (not a CPM engine) report more predictable value than those chasing only organic payouts.

Net:

- Shorts = better top-of-funnel scale, monetization via what comes after.

- Reels = better brand signaling and deal surface, monetization via partnerships & ecosystem.

Neither is “bad for brand deals”.

Pain Point #3: Algorithms as Unstable Partners

By mid-2025, creators are done pretending they “understand the algorithm.” They understand patterns instead:

Shorts pattern creators call out

- Strong bias for early hook + completion rate.

- Sequences and recurring formats perform better than random one-offs.

- Niche clarity matters: channels throwing every genre into Shorts often see weaker conversion into long-form.

Also, view inflation and new view-count rules (scroll-past counting) are on creators’ radar. It forces a distinction between “views” and “real interest.”

Reel patterns creators call out

- Reels are now heavily integrated into Explore, suggested content, and feeds, but consistency and “fit” with the account still matter.

- Overly polished or fake brand content underperforms; native-feel Reels with a clear hook and personality win.

- Engagement quality (saves, shares, replies, DMs, clicks) beats vanity views when brands assess you.

Both algorithms increasingly reward clear positioning + strong retention, not random volume. “Spray and pray” is dead.

So, Which is Better for Promotion?

It depends on what you’re promoting and how far you’re thinking ahead.

If your main goal is reach and growth velocity, YouTube Shorts still has the upper hand. The scale is absurd: billions of daily views, stronger discoverability, and a growing link between Shorts and the rest of YouTube’s ecosystem. Shorts can turn a single viral moment into long-term channel growth, but only if there’s something for viewers to land on next. Treat Shorts as a front door, not a house.

If your goal is brand positioning and monetization through partnerships, Instagram Reels remains the safer and more direct play. In 2025, brands are still investing more into Reels than Shorts thanks to Instagram’s built-in monetization stack: affiliate tagging, product links, and native branded content tools. Reels also convert faster in lifestyle, fashion, beauty, and travel categories, where brands prefer consistency and aesthetic alignment.

But the landscape is shifting fast, and YouTube is closing the gap. With new BrandConnect features, sponsorship tagging, and creator commerce tools, YouTube Shorts are evolving into a serious player in the brand collaboration space.

The most sustainable creators don’t pick sides. They use both strategically.

- Shorts bring the audience in.

- Reels turn that attention into relationships and revenue.

Some creators already execute this hybrid strategy. Look at:

- @NickDiGiovanni

Food content that uses Shorts for recipes and Reels for partnerships and lifestyle.

- @Kallmekris

Comedy that hits fast on Shorts and goes personal on Reels.

- @Mrwhosetheboss

Tech breakdowns using Shorts for reach and Reels for lifestyle/behind-the-scenes.

- @JennyHoyos

Gen-Z voice and storytelling that thrives in both Shorts’ speed and Reels’ polish.

These creators are testing, measuring, and adapting for both platforms.

ScaleLab works with creators who want to build smarter.

We analyze what drives real growth on your channel, help you scale your strategy, and align it with brand-ready content that converts.

Want to see how you could grow faster? Let’s talk! We’ll help you find what’s really working for you in 2025.